What’s in and out of Trump’s big bill as Senate races to meet Fourth of July deadline

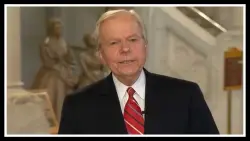

By LISA MASCARO and KEVIN FREKING WASHINGTON AP President Donald Trump says NO ONE GOES ON VACATION until the big beautiful bill is on his desk by the Fourth of July deadline And Republicans in Congress are staying put to get it done Related Articles Early US intelligence account suggests US strikes only set back Iran s nuclear initiative by months Trump administration asks Supreme Court to clear the way for a South Sudan-bound deportation flight Justice Department official suggested ignoring court orders on deportations whistleblower maintains Powell says Fed rate cut is on hold even as Trump demands cuts Fragile ceasefire appears to hold between Iran and Israel as Trump vents frustration with both sides The Senate is gearing up for weekend work while House Speaker Mike Johnson advised lawmakers Tuesday to keep their schedules flexible as they prepare for more votes We are making good headway declared Senate Majority Leader John Thune R-S D He expects the Senate will get this past the finish line by the end of the week sending it back to the House for swift action But Republicans who have majority control of the House and Senate are finding that their push to move fast and change things namely cuts to federal administration programs including Medicaid and SNAP food stamps used by millions of Americans is easier stated than done Not all GOP lawmakers are on board and the Senate parliamentarian has advised that several key proposals violate procedural rules With Democrats flatly opposed it s all leaving GOP leaders scrambling days before final votes Here s the latest on what s in out and still up for debate as lawmakers work to finish the massive -page plus package What s the goal of the big bill Tax cuts The top priority for Republicans is preventing what they warn would be a massive tax hike particular trillion after December when the tax breaks they put in place during Trump s first term in expire The big bill seeks to make existing tax rates and brackets permanent while also temporarily adding new ones Trump campaigned on no taxes on tips overtime pay or selected automotive loans along with a bigger deduction in the Senate draft for seniors who earn no more than a year Senate Majority Leader John Thune R-S D speaks with reporters about the process to advance President Donald Trump s spending and tax bill during a news conference at the Capitol in Washington Tuesday June AP Photo J Scott Applewhite The wealthiest households would see a increase while the bill would cost the poorest people a year according to the nonpartisan Congressional Budget Office Middle income taxpayers would see a tax break of to CBO declared One provision for families would boost the child tax credit to under the Senate proposal or in the House But families at lower income levels won t see the full amount if any And one unresolved issue is the House s proposed cap on state and local deductions called SALT that GOP senators say is too high and want limited The bill also funds deportations a dividing line wall and Trump s heroes garden There s also several billion of new funding in the package for Trump s territory line and national guard agenda Trump promises the largest mass deportation operation in U S history and the package proposes money to hire new Immigration and Customs Enforcement officers with signing bonuses and for immigration detention beds with a goal of deporting certain million people a year Additionally the House bill proposes billion for the Homeland Guard secretary to provide grants to states that help with federal immigration enforcement and deportation actions The Senate package also provides the attorney general with billion to create a similar state fund called Bridging Immigration-related Deficits Experienced Nationwide or Biden referring to the former president Immigrants entering the U S would face stiff new fees including for those seeking asylum protections Speaker of the House Mike Johnson R-La talks about his discussions with Elon Musk this week as he meets with reporters to discuss work on President Donald Trump s bill of tax breaks and spending cuts at the Capitol in Washington Wednesday June AP Photo J Scott Applewhite There s also money for the evolution of Trump s Golden Dome missile defense system over the U S and quality of life measures for servicemen and women And there are extras One provision from the Senate would provide million to establish Trump s long-sought National Garden of American Heroes How to pay for it Cuts to Medicaid SNAP and green vigor programs To help partly offset the lost tax revenue Republicans are seeking to cut back chosen long-running executive programs Medicaid food stamps and green vitality incentives basically unraveling the accomplishments of the past two Democratic presidents Joe Biden and Barack Obama Republicans argue they are trying to right-size the safety net programs for the population they were initially designed to serve mainly pregnant women and children and root out waste fraud and abuse The package includes new -hour-a-month work requirements for various adults receiving Medicaid and food stamps including older people up to age Parents of children older than would have to work to qualify for food aid and those with teens would have to comply with the work requirement for Medicaid It s wildly popular Johnson revealed Tuesday noting people can work volunteer or go to school or job training programs For heaven s sake do something constructive Senate Minority Leader Chuck Schumer D-N Y is joined by Sen Elizabeth Warren D-Mass left ranking member of the Senate Banking Housing and Urban Affairs Committee and Sen Ron Wyden D-Ore the ranking member of the Senate Finance Committee as he talks to reporters about Senate Republicans efforts to pass President Donald Trump s tax cut and spending agenda with deeper Medicaid cuts at the Capitol in Washington Wednesday June AP Photo J Scott Applewhite Particular million Americans rely on Medicaid which expanded under Obama s Affordable Care Act and million use the Supplemental Nutritional Assistance Campaign and bulk already work according to analysts All communicated the CBO estimates at least million more people would go without wellness coverage and million more would not qualify for food stamps Deeper SNAP cuts that would shift cost-sharing to the states were called into question by the Senate parliamentarian and undergoing revisions And more Medicaid changes are up for debate including a Senate plan to reduce the so-called provider tax that preponderance states impose on hospitals and other entities Key GOP senators and a coalition of House Republicans warn that lower Medicaid provider tax cuts will hurt rural hospitals We cannot promotion a final bill that threatens access to coverage mentioned House GOP lawmakers in a letter to leadership Senators are considering the creation of a new rural hospital fund but the plan remains a work in progress They ve also had objections to the House s proposed new co-pay on Medicaid services Both the House and Senate bills propose a dramatic rollback of the Biden-era green vigor tax breaks for electric vehicles and also the production and funding tax credits companies use to stand up wind solar and other renewable ability projects FILE Sen Josh Hawley R-Mo speaks during a confirmation hearing at the Capitol in Washington Jan AP Photo Ben Curtis File All notified the cuts to Medicaid food stamps and green force programs are expected to produce at least trillion in savings What s the final cost Altogether keeping the existing tax breaks and adding the new ones is expected to cost trillion over the decade CBO says in its analysis of the House bill The Senate draft is slightly higher The spending cuts tally at least trillion The CBO estimates the package from the House would add trillion to the nation s deficits over the decade Or not depending on how one does the math Senate Republicans are proposing a unique strategy of not counting the existing tax breaks as a new cost because they re already current guidelines They argue the Budget Committee chairman has the authority to set the baseline for its preferred approach Under the Senate GOP view the cost of tax provisions would be billion according to the congressional Joint Committee on Taxation Democrats and others argue this is magic math that obscures the costs of the GOP tax breaks The Committee for a Responsible Federal Budget puts the Senate tally at trillion over the decade Current approach baseline is a budget gimmick revealed Sen Jeff Merkley the top Democrat on the Budget Committee This bill will add trillions upon trillions of dollars to the national debt to fund tax breaks for billionaires Trump en trail to Europe for a NATO meeting stated senators to lock themselves in a room if needed and GET THE BILL DONE Associated Press writesr Darlene Superville and Mary Clare Jalonick contributed to this review